EMV Chips and What They Mean for Your Business

What is EMV?

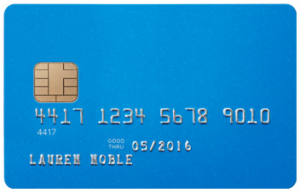

Named for the three companies that created it – Europay, Mastercard, and Visa – EMV is fraud-reducing technology consisting of a tiny chip embedded in cards that is virtually impossible to counterfeit. Already used in 2 billion cards around the world, especially in Europe and Canada, this chip creates a unique, encrypted electronic signature with each use, proven to protect the issuer, merchant and consumer from cyber-criminals. And starting October 1, 2015, all major card companies will be implementing EMV in the US. (*VISA, Mastercard, Discover, and American Express)

Named for the three companies that created it – Europay, Mastercard, and Visa – EMV is fraud-reducing technology consisting of a tiny chip embedded in cards that is virtually impossible to counterfeit. Already used in 2 billion cards around the world, especially in Europe and Canada, this chip creates a unique, encrypted electronic signature with each use, proven to protect the issuer, merchant and consumer from cyber-criminals. And starting October 1, 2015, all major card companies will be implementing EMV in the US. (*VISA, Mastercard, Discover, and American Express)

How do I know if my machine will accept these cards?

All EMV cards will still contain a magnetic stripe, meaning you can continue to process as normal if you have an older terminal. The newer terminals should have a slot to “dip” the card in instead of swiping it. The card will stay in the reader reading the chip until the transaction is finished.

All EMV cards will still contain a magnetic stripe, meaning you can continue to process as normal if you have an older terminal. The newer terminals should have a slot to “dip” the card in instead of swiping it. The card will stay in the reader reading the chip until the transaction is finished.

What happens if I don’t have an EMV-compliant terminal?

After October 1, 2015, if a consumer uses an EMV chip card with a merchant who doesn’t have an EMV-compliant terminal, and the transaction is found to be fraudulent, the liability for any charges is left with the merchant.

Do I have to have an EMV-compliant machine?

No. After Oct 1st, you will still be able to process both standard and chip cards using the magnetic stripe. BUT – you should calculate the risk to determine if keeping the old terminal is worth the liability. Ask yourself:

- How many charge-backs or fraudulent items do I regularly have a year?

- How much is the average ticket price of each transaction?

- Would the cost of a year’s worth of fraudulent items be more or less than a new machine?

- Would the cost of a new machine be worth it for the added security for my customers?

- Are there additional benefits in a new machine besides the EMV compliance piece?

- Where am I in my contract with my current machine?

How can I get more information?

There are a variety of solutions to ensure you are ready. Be wary of “doomsday” salesmen on the phone who are preying on merchants and offering over-priced terminals that may not be needed. Instead, contact Aubry Dieter with Emprise Bank at 316-776-1500, or speak with your current banker to assess if you are ready. You can also visit www.firstdata.com to learn more about how this can affect your business, your customers, and what solutions are available.